What’s the most critical element of a successful business? Is it a flawless, solution-orientated product line? Is it a customer-driven marketing strategy? Or is it a coordinated supply chain and sales revenue? While all are crucial, what’s the most vital objective everything revolves around?

Profits.

And to ensure the numbers are precise and correctly interpreted, every business must have meticulous financial management. Money is the blood if a business is compared to a human body! Companies spend millions on ensuring that everything is efficiently accounted for. A couple of decades ago, accounting and bookkeeping were done manually.

However, with technology, accounting operations are automated, like every other department. Businesses now rely on software and payroll solutions to manage their finances. The accounts receivable automation market is expected to increase from $3.3 billion in 2022 to $6.5 billion in 2027, at a Compound Annual Growth Rate (CAGR) of 14.2% throughout this time, according to a report by Markets and Markets. Asia-Pacific is expected to have the most incredible. CAGR.

This blog explores highly affordable and efficient accounts receivable and invoicing software for small and large businesses.

ZarMoney

ZarMoney is a feature-rich account receivable software for growing businesses. With ZarMoney’s accounts receivable feature, you can manage invoices, receive payments, and stay up-to-date with the receivables. ZarMoney is a flexible and feature-rich solution for all your financial needs.

ZarMoney is developed to assist businesses in enhancing their productivity while decreasing costs and making manual errors. This software can monitor all expenses and revenues from a central location. Moreover, it offers several productivity features, including a scheduler, a customizable dashboard, and email/text notifications.

Also, it has a highly sophisticated inventory management feature panel that intelligently takes care of your inventory. You can create pick lists, track items and history, get real-time inventory data, and manage multiple warehouses seamlessly.

Top Features

- Customer & Accounts Receivable.

- Invoicing.

- Quotes & Estimates.

- Quick Sales.

- Sales Orders.

- Customer Statement.

- Payment Terms.

- Vendors & Accounts Payable.

- Bills & Expenses.

- Print Checks.

- Purchase Orders.

- Payable Center & Calendar.

- Automatic Matching.

- Inventory Management.

- Reporting.

- FIFO Cost Methods.

Pros

- Value for money.

- Exceptional customer support.

- Easy to use.

Pricing

- Entrepreneur: $15/month/ 1 user.

- Small Business: $20/month/ 2 users.

- Enterprise: $350/month/ 30+ users.

Ratings

4.7/5 on Getapp.

QuickBooks Online

QuickBooks Online is an online accounting solution for small businesses. It’s easy to set up and use, affordable and has a mobile app, and you can even use it for invoicing and payroll.

If you have a large corporation with hundreds of employees working in different departments worldwide, then QuickBooks Enterprise might be right for you. This software has all the features of QuickBooks Online. Still, it includes more advanced features like inventory tracking, which allows companies to manage their inventory more efficiently by tracking each item’s location within their warehouse or storeroom and its value at any given time.

Top Features

- Invoicing

- Expenses

- Reports

- Bank Feeds

- Inventory

- GST & VAT

- Multi Currency Support

- Mobile App

- Security

Pros

- Outstanding customer service.

- Precise and clear reporting.

- Seamless expense tracking.

Pricing

- Self-Employed: $20/month.

- Simple Start: $25/month.

- Essentials: $37/month.

- Plus: $55/month.

Ratings

4.3/5 on Getapp.

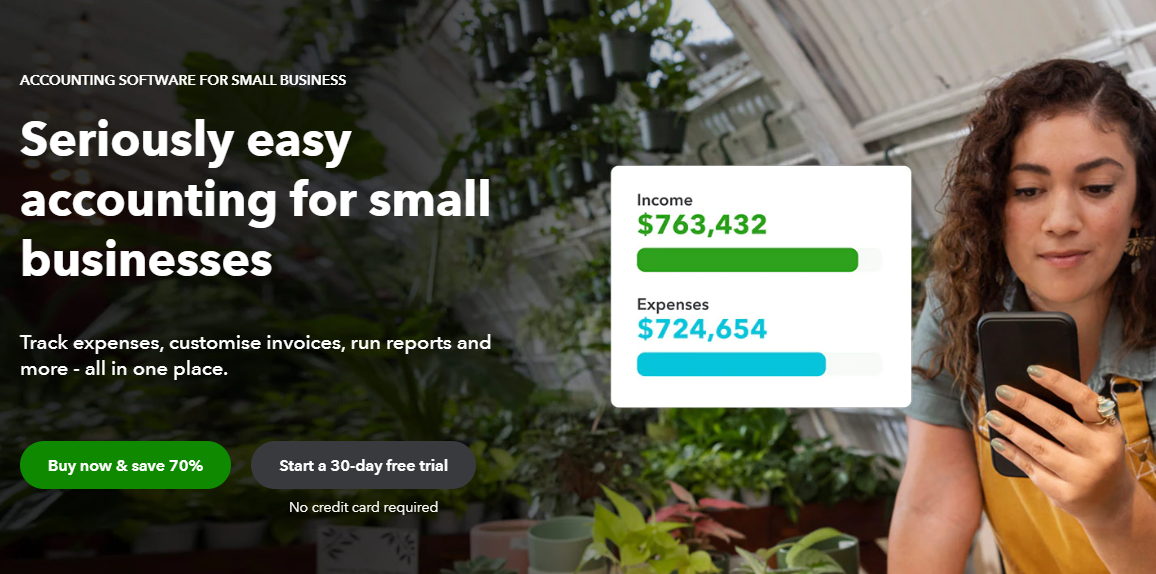

Freshbooks

Freshbooks is a cloud-based accounting software that allows small businesses to manage their revenue, expenses, and clients from anywhere. It’s easy to use and has a simple interface. FreshBooks also has a mobile app for Android and iOS devices that can be used on the go by employees who need receipts or invoices for their clients.

Top Features

- Multi-Client Management

- Accounting

- Book Keeping

- Mileage Tracking

- Proposals

- Projects

- Payroll

- Time Tracking

- Online Invoicing

- Estimates

Pros

- Easy to use interface.

- Seamless invoicing.

- Exceptional financial reporting.

Pricing

- Lite: $15/month – 5 clients.

- Plus: $30/month – 50 clients.

- Premium: $55/month – unlimited clients.

Ratings

4.5/5 on Getapp.

Sage50Cloud Accounting

Sage 50cloud Accounting is a cloud-based accounting solution designed to help small business owners and entrepreneurs manage their finances. Sage 50cloud Accounting offers all the features you need to manage your business, including invoicing, payment processing, inventory management, purchase orders, and more.

Top Features

- Cash Flow & Invoicing

- Advance Inventory Management

- Job Costing & Payroll

- Payments & Banking

- Job Costing

- Payroll

- Reporting

Pros

- Holistic framework.

- Easy to use.

- Highly functional.

Pricing

- Sage 50cloud Pro Accounting: $340/year.

- Sage 50cloud Premium Accounting: $510/year.

- Sage 50cloud Quantum Accounting: $842/year.

- Microsoft Office 365 integration is available for $150/year.

Ratings

3.8/5 on Getapp.

Zoho Invoice

Zoho Invoice is a free invoicing tool with all the features you need to start your business. It offers a built-in accounting system, payment gateway, and sales reporting system so you can keep track of all your financial transactions with ease.

Zoho Invoice also comes with many other valuable functions, such as time tracking, emailing invoices from within the app (no more trying to attach files), tracking expenses by location, and managing custom fields in transactions effortlessly.

Top Features

- Estimates

- Client Portal

- Expenses

- Bills

- Banking

- Projects

- Inventory

- Sales Orders

- Purchase Orders

- Online Payments

- Reporting

- Automation

- Documents

- Vendor Portal

Pros

- Seamless integration.

- Automation workflow.

- Branding on invoices.

Pricing

- It’s 100% free.

Ratings

4.6/5 on Getapp.

Xero

Xero Accounting Software is a cloud-based accounting software that’s easy to use and can be used by small businesses. The free plan allows users to do essential accounting functions like tracking expenses and payment history. The paid plans also offer access to advanced features like invoicing, forecasting, and more.

Xero has an easy-to-use interface with features like drag-and-drop functionality for importing data from other applications into Xero’s system. This helps streamline your business operations while saving time by automating repetitive tasks. It also has mobile apps available to access the same information wherever you are – whether on your phone or tablet computer!

Top Features

- Accounts Receivable

- Billing & Invoicing

- Activity Tracking

- Expenses

- Bank Connections

- Accept Payments

- Bank Reconciliation

Pros

- Outstanding integration potential.

- Easy to use.

- Value for money.

Pricing

- Early: $5.50/month.

- Growing: $16/month.

- Established: $31/month.

Ratings

4.4/5 on Getapp.

Wrapping Up

To conclude, every invoicing and account receivable software offers a variety of features. However, as a business, see which one fits your requirements and budget. A particular software might be suitable for a specific industry and unsuitable for another. You must explore the features and pricing to make an informed decision. Our recommendation? We’ve based our advice on seeing which software fits a generic business model best. While all the above are impressive, ZarMoney is the way to go! It offers value for money, ease of use, and a variety of features.